How much is a lot of money to you? $1 million? Who wants to be a millionaire?

Depending on your number, you could more realistically start to consider changing careers, relying on your spouse’s income if any, or living independent income.

Done daydreaming? Get back to work.

A lawyer’s salary is actually not even a lot of money

As lawyers earn on a bimodal curve, and because you work enough hours to justify the top end of the scale, it’s hard to tell when you’ll pay off your loans and start saving toward retirement.

Let’s say you are a mid/senior-level associate at a non-biglaw firm. Let’s say you’re making a healthy salary of $150,000 a year. Again, you may earn way more or way less. This is just for illustration. Follow along with your number.

$150,000 gross (no 401(k) contributions—we’ll address that below) is approximately $8,462 a month net in California. Use this calculator to estimate your own numbers based on your location.

- If you take the average American saving rate of around 10%, you end up with $846.20/mo x 12 mo/yr = $10,154.40 a year.

- If you go with a respectable 25% saving rate, you end up with $25,386 saved in one year.

- If you go the way of FIRE (financial independence, retire early) and save 50% or more, you end up with $50,772 saved per year. That’s enough runway for one year’s basic expenses and possibly leftover emergency funds!

If this is all you did and continued to save at this rate (assuming same salary—but things get better below), you’d end up working 19 more years to reach $1 million. It’s not too bad considering the typical American retirement age of 65.

But if you’re feeling burned out now, 19 years is way too long to keep doing this. A good job needs to be sustainable.

Even if you tucked away half of your income, you’d have to keep doing this for the same amount of time it takes for a fetus to reach voting age. This is not even mentioning any student loans putting your net worth in the negative.

Can you suck it up for that long? If you hate every second of your life, you can’t keep living the way you feel right now for 19 more years!

That’s why you need to stop depending on your salary eventually. The more you spend it, the more reliant and addicted you become to that check hitting on the 15th and 30th. Take control of your money. Don’t let it use you. Make your money work for YOU.

“The three most harmful addictions are heroin, carbohydrates, and a monthly salary.”—Nassim Taleb

Use the 4% rule as a guide to figure out how much you need for perpetual income

Without getting into the details of the so-called Trinity Study this is based on, the 4% rule suggests that you can safely withdraw 4% of your portfolio every year for a 30-year period without depleting your capital (adding a bit every year to account for inflation) without running out of money.

You can thus calculate that your annual expenses x 25 is your critical-mass number needed. For example, if you currently want to be able to spend $40,000 a year ($3,333/mo) for the next 30 years, then your number would be $1 million before you can fuck off into the sunset.

You can visualize this on FIRECalc. You’ll likely end up with more than $0 by the end of 30 years, but you want to be safe.

While you could make this work in theory based on a study of stock market performance of 30-year periods, I prefer to be a bit more conservative and use a 3.3% withdrawal rate over 55 years. Lawyers are risk-averse people. There’s still a possibility that you’ll run out of money sooner than you prefer:

- We may experience a terrible stock market cycle in the future worse than any simulation.

- You may need more than expected in the future. Large expenses like cars, kids, etc.

- You may need money longer than 30 years, beyond which the assumptions of the Trinity Study wouldn’t apply.

But there are ways around it:

- You could take on work you actually enjoy, full time or part time.

- You might have a partner who can bring in income.

- You’ll very likely pay less taxes because you have standard deductions, and you’re only taxed on long-term gains in taxable accounts. You don’t get taxed on the principle, long-term gains under $40,000 (as of 2021 for single tax filers), and gains in tax-advantaged accounts like Roth IRA.

Whatever the case, the key is to start building your portfolio as soon as possible to reach your goal sooner and thereby reduce risk (and how long you work) as much as possible. Time is your friend.

Use compound interest to grow your savings

“Compound interest is the eighth wonder of the world.”—Albert Einstein

You’d need to take advantage of compound interest and all investment options available to you. Play around with this calculator by SmartAsset.

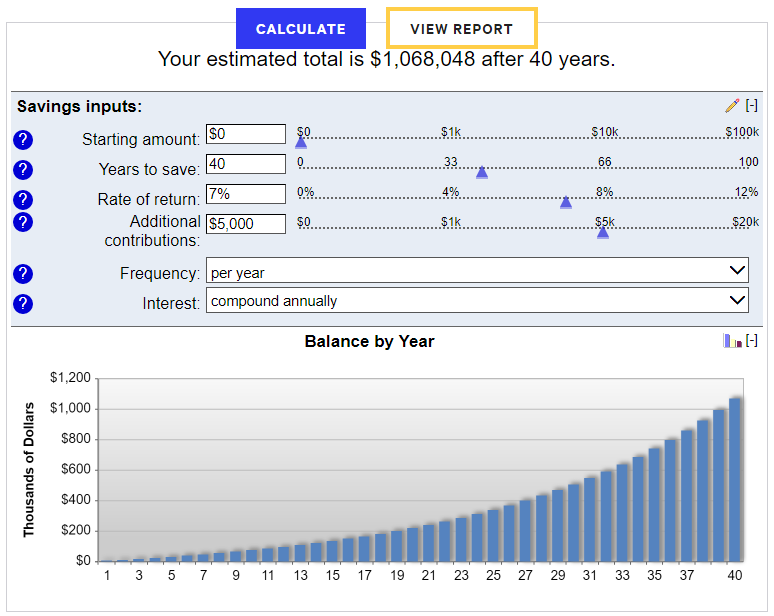

- Even $5,000 compounded at 7% over 40 years is $1 million. If you tuck away $5,000 a year in a savings account, it’ll take you about 200 years.

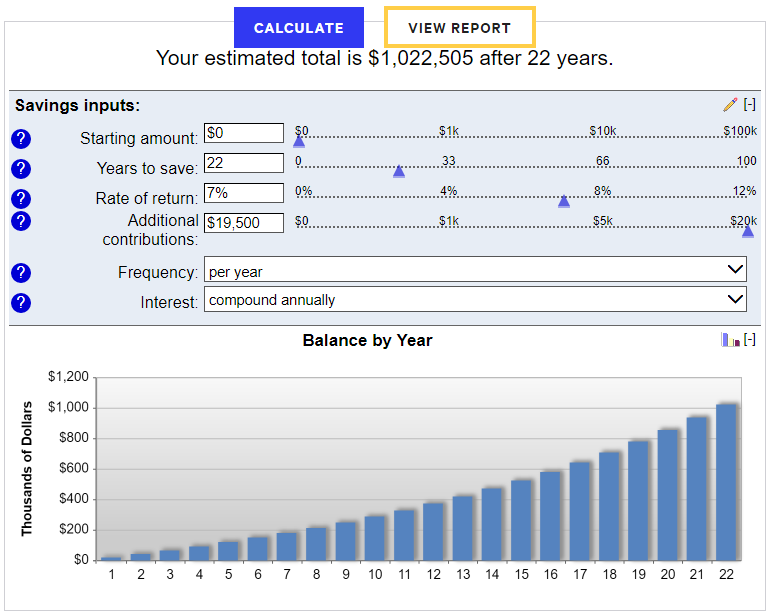

- Your firm should offer a 401(k). Max this out. If you max it out ($19,500/yr), you end up with $1 million after 22 years. This contribution is also pre-tax money, meaning your taxable income in this example will go down to $130,500.

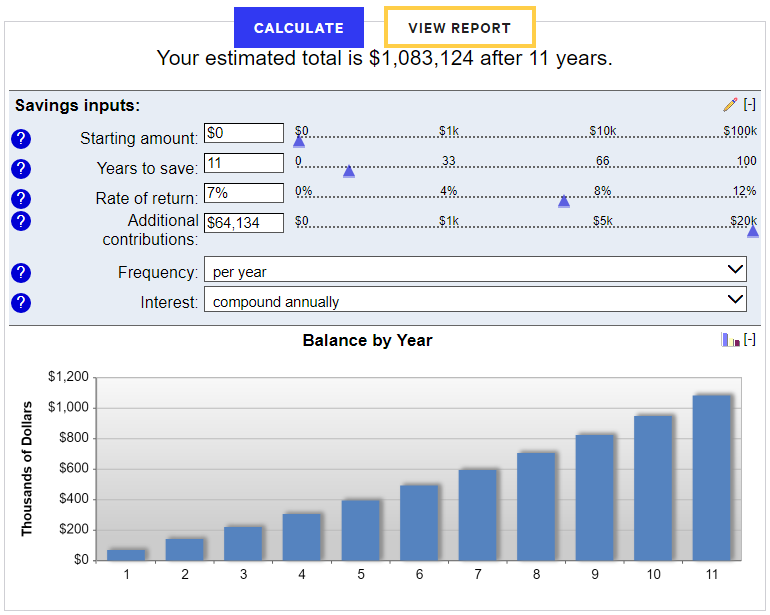

- You can further crank the flywheel by putting more of your savings into investments, dramatically lowering the time you have to endure burnout. Combine the 401(k) with your 50% savings ($44,634 per the SmartAsset calculator), and you may find financial freedom in 11 years.

See the corresponding screenshots below.

This isn’t counting any cash you stash.

As you progress in your career, you’ll have more to chip into your retirement/FIRE fund. However, you have to do your own balancing test to see whether you want to burn yourself out more to find freedom faster or keep it more sustainable.

But TIME is your greatest friend in compounding your assets. Notice that most of the gains are in the later years. Your money grows exponentially over time.

Just a note: Your money isn’t going to grow in a perfect curve like the above. 7% a year is on average over a long time frame. In reality, one year may be up 20% (or more) and another year down 10% (or more). Over the long term given data until 2009, we can assume a historical return of 7%, 11% with inflation, which is removed above to account for inflation.

The past does not guarantee the future…

But we can believe in the American capitalist productivity machine and the pursuit of the American Dream to bring profit to shareholders and push stock prices up.

How should you invest?

If you’re new to investing, you might think it’s about picking the right stocks or crypto and hope that memes will take your portfolio to the moon. Time in the market beats timing the market. You can’t go wrong with broad low-cost index funds at Vanguard.

If your goal is the option to never work again, your goal should be to own sufficient assets using a safe and boring method of investing that is done consistently, automatically, and regularly. They are the same goals.

This is outside the scope of this article and is mostly up to you (may be a topic for another one). But it’s important to get started earlier than later.

Leave a Reply

You must be logged in to post a comment.